retroactive capital gains tax history

Here is a synopsis of capital gains tax history. More specifically in August of 1993 Congress passed the Omnibus.

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Retroactive Changes to Long-Term Capital Gains.

. The Court reasoned that. The 1913 Revenue Act was the first one with an effective date. These changes would relate back to April 28.

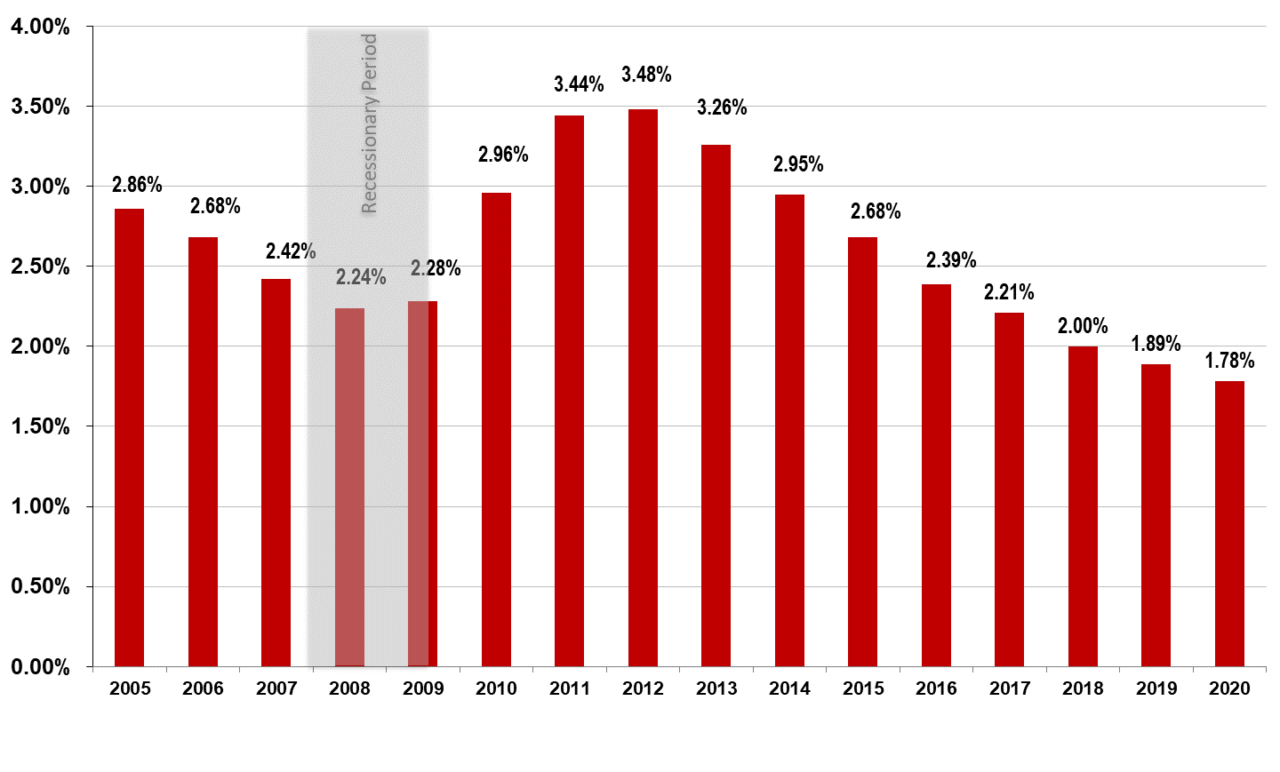

Congress has been adopting retroactive tax increases for a very long time essentially since the 1930s. Therefore the top federal tax rate on long-term capital gains is 238. 1 the legislation has a rational legislative purpose and is not arbitrary.

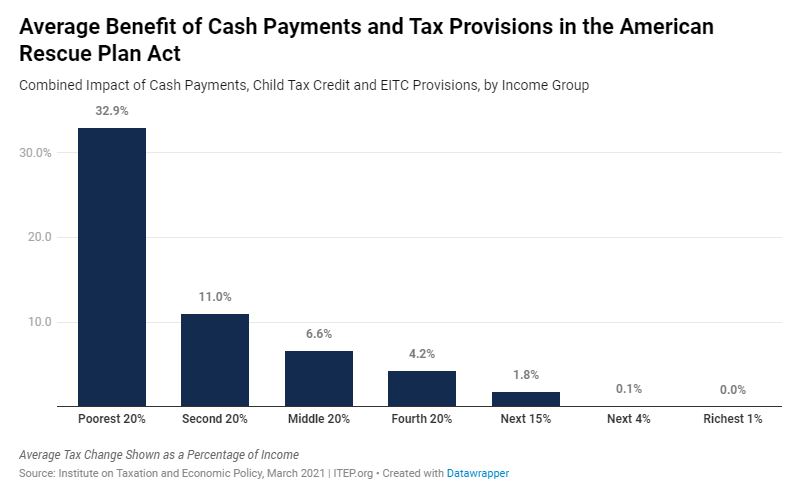

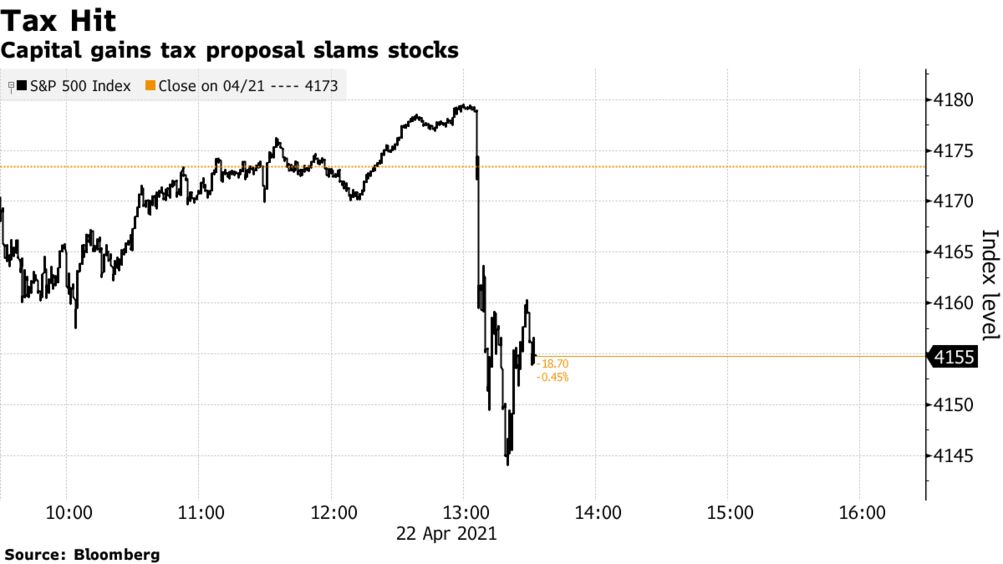

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. In a state whose tax is stated as a percentage of the federal tax liability. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act.

Effective for taxable years beginning after 31 December 2012 ie. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along. With this retroactive income tax.

Iv From the 1940s through 1979 these taxes ranged from. Biden Tax Plan Is Forecast To Bring In 3 6 Trillion Over Decade. And so the Biden administration proposes to increase the capital-gains top rate from 238 percent to 434 percent to pay for its 6 trillion American Families Plan which.

The Green Books proposed change to long-term capital gains is retroactive. Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains.

Signed 2 January 2013. The corporate tax rate on long-term capital gains currently is the same as the tax rates applicable to a corporations ordinary income. Signed 2 January 2013.

And 2 the period of retroactivity is not excessive. There are numerous issues with any mark-to-market scheme but. One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike.

Most states tax capital gains as ordinary. The Economic Impact Of Tax Changes 1920 1939 Cato Institute. Significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition rule that functionally split.

Under a mark-to-market system unrealized capital gains would be taxed on an annual basis just as if they had been realized. Biden Tax Proposals Highlights From The. While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated.

112240 Introduced 24 July 2012. Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. Effective for taxable years beginning after 31.

Indeed we need not look back too far in history to find a prime example of retroactive tax increases. American Taxpayer Relief Act of 2012 Pub. Issue Date December 1988.

The test upholds retroactive tax application if. From 1913 through 1934 capital gains tax jumped from 7 to 125. State and local taxes often apply to capital gains.

A New Era In Death And Estate Taxes

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

Covid 19 Tax Policy Resources Itep

Doing Business In The United States Federal Tax Issues Pwc

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

Managing Tax Rate Uncertainty Russell Investments

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Income Tax Increases In The President S American Families Plan Itep